Hotel Investment Partnerships

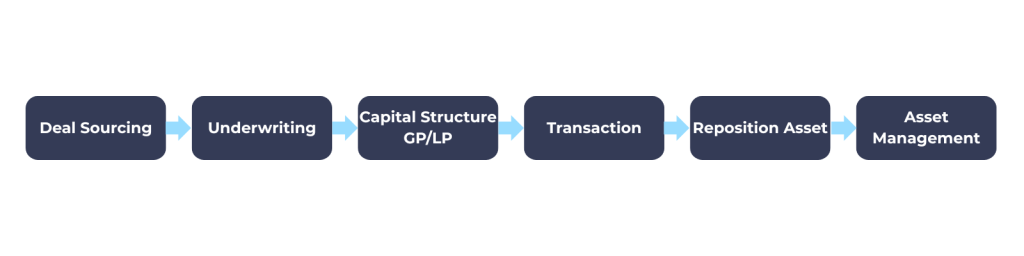

Hotel Appraisers & Advisors (HA&A) helps qualified investors access institutional-quality hotel investments through a focused GP/LP structure.

In these partnerships, HA&A serves as the sponsor, underwriter, and ongoing asset manager, while our limited partners (LPs) provide 100% of the equity capital for each deal.

We focus on niche hotel and hotel-related investments that are often too small, too complex, or too specialized to attract the attention of large institutional investors—but can offer compelling risk-adjusted returns when they are underwritten and managed correctly.

Why Partner with HA&A on Hotel Investments?

1. Deep, Hotel-Specific Experience

- Over two decades focused almost exclusively on hotel appraisals, feasibility, and asset management

- Hands-on involvement with a wide range of independent, branded, and public-private hotel assets

- Real-world operating insight from restructuring labor models, optimizing F&B, and repositioning underperforming assets

2. Underwriting Grounded in Valuation and Real Data

- We approach new deals with the same discipline we bring to valuation and asset management assignments

- We use market data, comps, and realistic pro formas—not just broker pitch decks

- Our goal is to identify mispriced risk, inefficient operations, and under-managed assets, not chase aggressive pro forma stories

3. Access to On-Market and Off-Market Deal Flow

- Through our consulting practice and industry relationships, we see a large volume of on-market and off-market hotel opportunities each week

- Many of these opportunities are:

- Too small or too specialized for large funds

- Located in secondary or tertiary markets

- Connected to universities, healthcare systems, or public-private initiatives

- This creates a targeted pipeline of potential acquisitions that may fly under the radar of larger institutional investors

4. Integrated Sponsor, Underwriter, and Asset Manager

- We do not outsource the core thinking: the same mindset that underwrites the deal also monitors performance after closing

- We stay involved as asset managers, working directly with operators on labor, revenue management, and capital planning

- This continuity helps protect investor capital and keep the original investment thesis on track over time

5. Strong Industry Network

- Relationships with hotel operators, lenders, brands, and specialized vendors across multiple markets

- Ability to help ownership groups select the right third-party operator or franchise structure, not just the first one to raise a hand

- Experience negotiating hotel management agreements that align incentives and protect ownership

Our Role as Sponsor

As sponsor, HA&A is responsible for:

- Sourcing and screening deals – Using our appraisal and advisory vantage point to identify the top quintile of opportunities

- Underwriting and due diligence – Preparing detailed pro formas, market assessments, and sensitivity analyses

- Structuring the GP/LP partnership – Implementing a simple preferred return for LPs and a shared promote structure incentivizes long-term performance

- Coordinating financing – Assisting with lender selection, loan terms, and underwriting support as needed

- Selecting and overseeing operators – Running competitive searches and helping negotiate HMAs as well as franchise agreements

- Ongoing asset management – Tracking performance, working with operators on strategy, and reporting to LPs

Role of Limited Partners (LPs)

Our LP partners typically:

- Provide 100% of the equity capital for individual transactions

- May be individuals, families, family offices, or small-to-medium investment groups seeking diversified exposure to hotels

- Approve major decisions, including acquisitions, financings, major capital projects, and sales or other exit strategies

LPs receive favorable terms through:

- A preferred return

- Additional cash distributions from a shared promote

- Share of net transaction proceeds upon sale or recapitalization

Specific economics will vary by transaction and are documented in the partnership or operating agreements.

Types of Investments We Target

We focus on opportunities where our experience adds the most value:

- Independent and soft-branded lifestyle hotels in urban and strong secondary markets

- Public-private and mission-driven hotels, including projects connected to universities, healthcare systems, parks, or civic institutions

- Neglected assets with clear operational or repositioning upside with the right leadership and strategy

- Hotel-related businesses where our understanding of labor, revenue management, industry data, and capital can materially improve performance and value

We are especially interested in assets that:

- Are mis-managed or poorly positioned relative to their local competitors and market potential

- Can benefit from strategic oversight, more efficient staffing, better revenue management, or targeted capital investments

- Are overlooked by larger funds due to size, location, or perceived complexity and may be undervalued due to how they are positioned

Who Might Be a Good LP Partner?

We welcome conversations with:

- High-net-worth individuals and families seeking diversification into hotels, with investments ranging from $1m to $25m.

- Family offices and professionals seeking long-term real-asset exposure focused on the lodging industry

- Former or current athletes and public figures who want to build or expand their real estate platforms

- Small funds and investor groups seeking a specialized hotel partner rather than a generalist, all-funds asset manager

Important Note

This page is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any security. Any investment opportunity will be offered only to qualified investors, and only through formal legal documents and agreements prepared with appropriate legal and tax counsel.

Interested in Exploring Hotel Investments with HA&A?

If you would like to:

- Learn more about our hotel investment approach

- Be notified when we identify new acquisitions that may fit your risk and return goals

- Or discuss how hotel investments might fit into a broader portfolio

please contact us:

Hotel Appraisers & Advisors, LLC

Phone: 312-526-3885

Email: hdetlefsen@hotelappraisers.com