Separating Personal Property in Hotel Valuations

A hotel’s value can be categorized into real property and personal property. Real property includes the land and improvements. Personal property includes tangible[1] and, sometimes, intangible[2] personal property. When valuing a hotel for ad valorem tax purposes, it is often necessary to separate the tangible personal property value from the real property value, as many jurisdictions tax the real property separately. This article describes a methodology for separating the tangible personal property from the real property value of hotels.

Introduction by Example

I recently reviewed a hotel appraisal[3] in which the appraiser, retained by the hotel’s owner, developed an estimate of tangible personal property value as part of a tax appeal case. Using the Income Approach, the appraiser estimated the tangible personal property value was nearly $37 million. However, earlier in the report, the appraiser had used the Cost Approach to estimate the replacement cost of the hotel’s tangible personal property to be $20 million, or $17.5 million after depreciation. This was a red flag, as theoretically the Cost Approach and Income Approach should produce the same value indications, given adequate market information.

Somehow, when the appraiser went from the Cost Approach to the Income Approach, he ended up more than doubling his opinion of the hotel’s tangible personal property value. Removing this estimate from the combined value conclusion for the hotel’s real property plus tangible personal property value, the appraiser then derived a value for just the real property. So, by estimating such a high value for the tangible personal property, the remaining value allocated to real property appeared very low. This may have delighted the hotel owner, who was challenging the hotel’s real property tax assessment. But the appraisal was flawed. What went wrong?

Estimating Depreciated Personal Property Value

The Cost Approach is perhaps the most reliable and simple method of estimating a hotel’s tangible personal property value. In this approach, the appraiser simply estimates the replacement cost and depreciation of the tangible personal property. Two steps are required.

The first step is to estimate the replacement cost of the hotel’s tangible personal property. For a newer hotel, appraisers can review the property’s development budget and isolate the FF&E components to estimate the original cost of the hotel’s tangible personal property. Appraisers can also obtain contractor estimates or review budgets for comparable hotel developments to estimate FF&E replacement costs. If appraisers do not have reliable, in-house data of this nature, they can reference information from hotel development cost surveys, published by companies such as Cushman & Wakefield[4] or HVS[5].

In the example cited previously, the appraiser estimated the replacement cost for the FF&E was $40,000 per guestroom. So, the total replacement cost of tangible personal property for the 500-room hotel was $20 million.

The second step in this method requires the appraiser to estimate all forms of depreciation affecting the value of the tangible personal property. Three general categories of depreciation include physical deterioration, functional obsolescence, and external obsolescence. Physical deterioration generally corresponds with a property’s age, as wear and tear over time diminishes the value of such property. Functional obsolescence can occur when a hotel’s FF&E is outdated or inefficiently designed. External obsolescence can occur when factors outside the property change its value.

To estimate physical deterioration, an appraiser can compare the estimated remaining economic life of the hotel’s FF&E to its total economic life. In the example, the appraiser estimated the effective age of the FF&E was 1 year. He estimated the average total economic life of all FF&E items, in aggregate, was 8 years. Using a straight-line[6] depreciation calculation, the appraiser estimated that physical deprecation represented 12.5% of the replacement cost. The appraiser did not identify any functional obsolescence or external obsolescence affecting the hotel’s personal property. So, the resulting indication of depreciated tangible personal property value was 87.5% of $20 million, or $17.5 million.

Direct Capitalization Formula

Because the example cited involved a tax appeal case, the purpose of the appraisal was to develop an estimate of value for just the real property. As is typical in this sort of assignment, the hotel’s property tax expense was in dispute. This article will describe a methodology for estimating the values of a hotel’s tangible personal property and real property separately.

Typically, when valuing the combined real property and tangible personal property, an appraiser can employ either a direct capitalization technique or a yield capitalization technique to the hotel’s projected income, or EBITDA[7]. In this article we use the direct capitalization technique, which relies on the following basic appraisal formula:

Vo = Io / Ro

In this formula, Vo represents the combined market value of the hotel’s real and tangible personal property, Io represents the hotel’s stabilized income, and Ro is the overall capitalization rate for the hotel.

When a hotel’s real property tax expense amount is in dispute, or unknown, then Io cannot be determined. Appraisers often work around this by not applying any property tax expense to the stabilized income projection. The appraiser can then load[8] the tax rate into the capitalization rate instead. This technique allows the appraiser to reflect the tax burden in the capitalization rate rather than in the income stream.

Incorrect Estimate of the Personal Property

In the example, the appraiser had projected the hotel’s stabilized earnings, before property taxes, to be $19.2 million annually. He concluded that 9.0% was a reasonable overall capitalization rate. The effective local property tax rate was approximately 4.0% of the market value of the hotel’s real property. So, the appraiser calculated the tax-loaded capitalization rate to be 13.0%.

However, when a hotel’s property tax expense is in dispute, and when the hotel’s real property is taxed at a different rate than its tangible personal property, then this technique requires additional steps. Specifically, the income must be allocated appropriately to the real property and the tangible personal property, respectively. Moreover, the appraiser must apply different capitalization rates to these allocated income streams.

In the example, however, the appraiser inappropriately tax-loaded the overall capitalization rate with the real property tax rate. The appraiser then deducted the income he attributed to tangible personal property from the hotel’s stabilized income stream, before applying the inappropriate tax-loaded capitalization rate.

Moreover, the appraiser estimated that nearly $4.8 million of the hotel’s stabilized income was attributable to tangible personal property. This was another red flag during my review of the appraisal. The hotel development cost surveys cited in this article show that the cost of a hotel’s FF&E typically represents between 6.0% and 12.0% of a hotel’s total development cost. But the appraiser’s estimate of income attributable to tangible personal property represented about 24.9% of the hotel’s stabilized income, before property taxes.

So, the appraiser subtracted roughly $4.8 million from $19.2 million to estimate the income attributable to real property only. The appraiser then applied his tax-loaded overall capitalization rate to the remaining $14.4 million of income, as shown in the following formula:

VRP = IRP / RRP

In this formula, VRP represents the value of the real property only. IRP is the income attributed to real property, which the appraiser estimated to be $14.4 million. RRP should be the real property capitalization rate loaded with the real property tax rate; however, the appraisers used 13.0%, which is the overall capitalization rate loaded with the real property tax rate. So, the appraiser calculated the real property value as VRP = $111.0 million. But, as indicated, there are at least two problems with this calculation.

Return “On” and “Of” Pitfall

Firstly, the appraiser overestimated the amount of income that should have been allocated to tangible personal property. To estimate this income, the appraiser argued that a typical hotel investor would require a return of and a return on the initial investment in FF&E.[9]

To calculate the income representing the return on FF&E, the appraiser assumed a 13.0% annual interest cost[10] for FF&E. Calculating 13.0% x $17.5 million, the appraiser estimated $2,275,000 as the income deduction representing a return on FF&E. The appraiser did not offer support for the interest cost assumption. As we will show later, the assumed interest cost is probably too high.

To calculate the income representing the return of FF&E, the appraiser divided the estimated replacement cost new of the FF&E by its estimated economic life of 8 years. In the example, this was $20.0 million ÷ 8 years = $2,500,000 annually. The appraiser concluded this amount represented the return of FF&E.

While this is a reasonable way to estimate how much it would cost an owner to replace new FF&E perpetually[11], this is not the same as replacing the depreciated FF&E just once. So, the appraiser has identified an annual expense that would be worth more than the depreciated value of the FF&E in place, thus further overstating the income attributable to the tangible personal property.

Combining the two erroneous calculations, the appraiser then deducted $2,275,000 as the return on tangible personal property and $2,500,000 as the return of tangible personal property from projected EBITDA. This was a total deduction from the hotel’s stabilized income stream of $4,775,000, intended to remove the present value of the tangible personal property. This is much higher than the $2,975,000 deduction we will conclude using the recommended methodology.

Both the appraiser’s return of and return on calculations were flawed. When combined, they produced a large inaccuracy. As we will see later, determining a reasonable personal property capitalization rate, which accounts for both a return of and a return on capital, may be a more reliable procedure.

Avoid Inappropriate Cap Rates

A second problem with the appraiser’s calculation for VRP is that the appraiser applied an overall capitalization rate to the income stream allocated for tangible personal property only. But capitalization rates should not be mixed up; they should be matched to their corresponding income streams.

In the hotel industry, overall capitalization rates are typically applicable to the combined hotel income streams that include both real and tangible personal property. If the appraiser wishes to capitalize the income attributable to just the real property, then a capitalization rate for the hotel’s real property should be used.

Since real-property-only hotel transactions rarely occur, if ever, it may be difficult to extract an appropriate capitalization rate from market sales. Similarly, because hotel investor surveys tend to focus on overall capitalization rates, applicable to the real property and tangible personal property combined, these capitalization rates from surveys should not be applied to real property only.

How can appraisers determine an appropriate capitalization rate to apply to the tangible personal property of a hotel?

Estimating Personal Property Cap Rates

Hotel Appraisers & Advisors recently evaluated terms from two lending institutions that offer loan products specifically for hotel FF&E. The terms of the loans on offer typically reflect the expected economic life of whatever FF&E the borrower is purchasing. These loans fully amortize over the defined term of each loan, which is usually 3 to 10 years. Payments are due monthly. The loan amounts can represent up to 100% of the cost of the FF&E. In recent months, annual interest rates were in a range around 8.0%, depending on credit quality and other factors, for hotels like the one being appraised.

In the example, FF&E was estimated to have an average economic life of 8 years. Given these market findings, an appraiser can calculate an estimated capitalization rate for tangible personal property, by using the following inputs on a financial calculator:

N = 8 years (or 96 months)

i = 8% (or 0.67% monthly)

PV = -$1

FV = $0

Solve for PMT

PMT = 0.1696/year

In this equation, PMT is the loan constant, or the loan capitalization rate. It represents the periodic payment due per dollar borrowed. On financial calculators, N is the number of periods in the loan’s term, i is the interest rate, PV is the present value of the loan per dollar borrowed, and FV represents a future loan value of zero because the loan must be paid off fully over its term.

As indicated, loans can currently be sized to the full cost of the FF&E, for approved loans. Since the loan-to-value ratio is 100%, this means the cost of capital for the FF&E is fully represented by the loan constant. So, the overall capitalization rate for tangible personal property should equal this loan constant. Therefore, the implied capitalization rate for the tangible personal property is approximately 17.0% in this example.

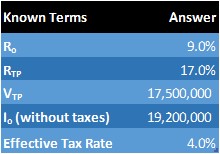

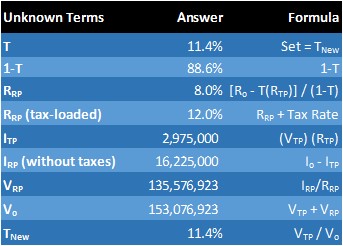

Solving for Real & Personal Property Values

At this point in the appraisal process, the appraiser has determined several key estimates needed to calculate the real and tangible personal property values. The following figure summarizes the key terms that are known.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

//

[1] A hotel’s tangible personal property is sometimes referred to as its Furniture, Fixtures, and Equipment, or FF&E. I use the terms interchangeably in this article.

[2] A hotel’s intangible personal property is sometimes called Business Value.

[3] Details have been changed for illustration purposes and to protect confidentiality.

[4] www.hotel-online.com/press_releases/release/hospitality-focus-on-construction-costs

[5] www.hvs.com/article/7730-us-hotel-development-cost-survey-201516

[6] Some appraisers use an accelerated depreciation schedule when market information supports it.

[7] Earnings Before Interest, Taxes, Depreciation, and Amortization, less a replacement reserve. This is sometimes referred to as earnings, net operating income, NOI, or simply income. I use these terms interchangeably in this article.

[8] A tax-loaded capitalization rate is the taxable property’s capitalization rate plus its effective property tax rate.

[9] The return of and return on an investment is analogous to the principal and interest payments for a home mortgage.

[10] The interest cost of FF&E is unrelated to the hotel’s tax-loaded overall capitalization rate. The fact that both are 13.0% in this case is coincidental.

[11] Throughout the economic life of the hotel.